Federal Tax Reform

What’s going on

12/22/2017: The Tax Cuts & Jobs Act was signed in to law this afternoon. Thanks to the hard work of affordable housing advocates, the law retains exemptions for private activity bonds and preserves the LIHTC. However, it did not include bipartisan reforms that would have the LIHTC to better serve households with low incomes and people experiencing homelessness.

Congress also passed a continuing resolution which keeps government running and delays final 2018 funding decisions until January 9th. For more on what is next, see the National Low Income Housing Coalition’s statement.

12/15/2017: The final conference report on the Tax Cuts & Jobs Act (HR 1) was released this afternoon and affordable housing advocates were heard! All core affordable housing and community development programs were retained.

- The low-income housing tax credit (LIHTC) and private activity bonds (PABs), including multifamily housing bonds, were retained.

- Retains New markets tax credits as currently authorized through 2019.

See this blog post from Enterprise for more details.

12/11/2017: Committee conferees will begin negotiating the tax bills passed by the House and Senate this week, with a goal of advancing a final bill through both chambers before Christmas break. Both Washington state Senators Maria Cantwell and Patty Murray are serving on the committee, though it is expected that democratic representatives will not be central to the negotiating.

The National Low Income Housing Coalition put out a call for action for advocates to tell Congress to oppose any tax bill that would worsen the affordable housing crisis and jeopardize disaster housing recovery. Contact your representatives now.

12/5/2017: The House has named its conferees who will be appointed to a temporary committee to negotiate points of difference between the House and Senate versions of the tax bill. Immediate outreach is needed to preserve multifamily housing bonds.

The Senate has not yet voted to go to committee nor appointed conferees, but advocates will need to continue pressing Senators ahead of their eventual vote on the final bill.

Contact your representatives in opposition to the Senate and House GOP tax bills

12/4/2017: Much remains unclear about the contents of the Senate’s tax bill, HR 1, in the two days since its passage. Michael Novogradac of Novogradac & Co has been tracking important affordable housing items. According to Diane Yentel, President & CEO of the National Low Income Housing Coalition, what we do know is bad news for affordable housing and the nation as a whole.

But it is not yet law. Over the course of the next week, House- and Senate-appointed conferees will negotiate points of difference between the tax bills passed by each body. If and when the Committee agrees to a final bill, that bill will need to pass both the House and the Senate.

Advocates must urge their representatives in the House and the Senate to achieve a bipartisan solution. That means scrapping both bills and starting over with a goal of fulfilling our country’s unmet affordable housing needs.

Affordable housing advocates are particularly sensitive to threats to private activity bonds (PABs) in the House bill. PABs are major drivers of affordable housing development, especially for older adults. Some specific talking points to consider, according to Novogradac:

- Retain private activity bond tax exemption, as in the Senate bill

- Retain 2018-19 rounds of the new markets tax credit, as in the Senate bill

- Retain the Senate version of the HTC, 20% taken over 5 years, and

- Current law phasedown of ITC and PTC, as in Senate bill.

12/2/2017: The Senate passed it’s tax bill early Saturday morning by a vote of 51-49, with all Democrats and 1 Republican opposing the bill. The bill, a 479-page document, was not final until hours before the 2 am (eastern) vote.

11/29/2017: The Washington D.C. office of the National Development Council will host a webinar tomorrow with an update on tax reform. Details & registration here.

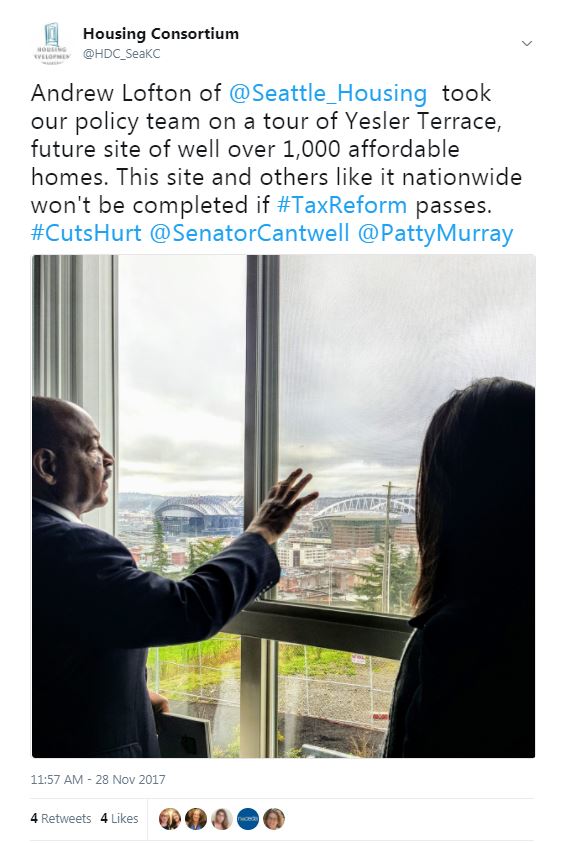

11/28/2017: The Senate tax reform bill has moved out of committee and will go to a full floor vote as early as next Thursday. It is imperative that every housing advocate reach out to their representatives in Congress- the House and the Senate- and urge them to vote no. Take action today:

- Contact your representatives in opposition to the Senate and House GOP tax bills

- Contact your representatives in support of HR 948, the Common Sense Housing Investment Act

11/27/2017: Urge the Senate to vote “no” on a bill that puts the future of federal investments in affordable housing at risk of deep cuts. Join the National Low Income Housing Coalition (NLIHC) in a Tweetstorm tomorrow, November 28th, beginning at 11 am PST. View sample tweets, find your representatives’ Twitter handles, and get analysis of the Senate plan here.

11/16/2017: The House passed its tax reform plan; the “Tax Cuts and Jobs Act,” today by a 227-205 vote despite widespread criticism from the affordable housing community. The bill now moves to the Senate, which is currently drafting its own Tax Reform plan.

Why we’re worried

As written, the Tax Cuts and Jobs Act poses a significant threat to affordable housing in Washington state and across the country. The bill leaves the Low Income Housing Tax Credit (LIHTC) in place, but eliminates private activity bonds (PABs, also called multifamily revenue bonds) which account for almost half of the LIHTC production nationwide.

Affording to analysis by Novogradac & Company, Washington state will lose the following over the next ten years if the plan becomes law:

- 51,680 affordable apartments

- 58,400 jobs

- $4.9 billion in business income

- $1.8 billion in local, state, and federal taxes

What we’re doing & how you can help

HDC submitted letters to Senators Cantwell and Murray and Representatives DelBene, Jayapal, Reichert, and Smith expressing our concerns.

- Read our letter to Representative Reichert

- Read our letter to Senators Cantwell and Murray and Representatives DelBene, Jayapal, and Smith

You can help by contacting your Representatives and urging them rise to our affordable housing need. Sample letters from the ACTION Campaign:

- Sample letter to Representatives who cosponsored the Affordable Housing Credit Improvement Act of 2017 (DelBene, Jayapal, and Smith)

- Sample letter to any Representative (Reichert)

- Sample letter to Senators (Cantwell & Murray)

Resources

Housing Tax Credit Fact Sheets from the ACTION Campaign:

- Washington State

- District 1 (DelBene)

- District 7 (Jayapal)

- District 8 (Reichert)

- District 9 (Smith)

WSHFC Press Release on House Tax Reform Plan (11/3)

House Tax Reform Bill Eliminates HTC, Senate Bill Preserves it at 10 Percent (Novogradac & Company)

Tax Messages that Work (National Human Services Assembly)

WSHFC Data Points:

Statewide figures:

- Without multifamily revenue bonds (which are PABs), almost half of the Low Income Housing Tax Credit program nationwide will disappear. And with it, thousands of jobs and millions of dollars for local economies (not to mention much-needed housing).

- In Washington state, 63% of our LIHTC production is through the bond program (aka the 4% housing tax credit).

- Much of this production is by for-profit developers building affordable apartments for working families and seniors. Nonprofits and public housing authorities also use the program.

- Units created in WA: 54,584 affordable apartments for working families over the last 30 years.

- Jobs and local investment: According to NAHB estimates of the impact of rental housing, the construction of these apartments has brought approximately 87,880 jobs, $6.4 billion in local income, and $1.2 billion in taxes and other government revenues to communities statewide.

- Dollars invested: The bonds themselves have brought in $3.3 billion to WA state and leveraged an additional $2.3 billion in LIHTC.

- Homeownership: PABs are also critical to help people become homeowners for the first time. In WA alone, more than 46,000 families have used a bond-financed mortgage to buy their first home.

Future production statewide:

- Earlier this month, the Housing Finance Commission received applications from 12 developers who hope to build or renovate 2,088 affordable apartments across the state.

- If private activity bonds disappear as of January 1, any of these projects that are unable to close by Dec. 31 will never be built. Any projects that would have been proposed later in the year (probably another 2,000 units at least) will also never be built.

King County—Bond/Tax Credit and Home Loan Production so far:

- 24,157 apartments

- Created 38,893 jobs, $2.8 billion in local income, $531 million in taxes

- Contributed to the economy: $1.4 billion in bonds and $1.2 billion in LIHTC

- Home loans for first-time buyers: 13,481 families